SR‑22 Insurance – Fast, Affordable & State‑Approved

Need SR‑22 insurance fast? Foxx Insurance helps drivers across

Florida, Illinois, Texas, California, Missouri, Arizona, Nevada, Virginia & South Carolina

file affordable, state‑approved SR‑22 insurance quickly and easily. We specialize in affordable SR‑22 insurance for high-risk drivers who need to meet state requirements after a violation.

What is SR‑22 Insurance?

SR‑22 insurance is not technically a type of insurance—it’s a certificate proving you’ve purchased your state’s minimum required liability coverage. It is required for drivers with:

- DUI/DWI convictions

- Driving without insurance

- Multiple traffic violations

- License suspension or revocation

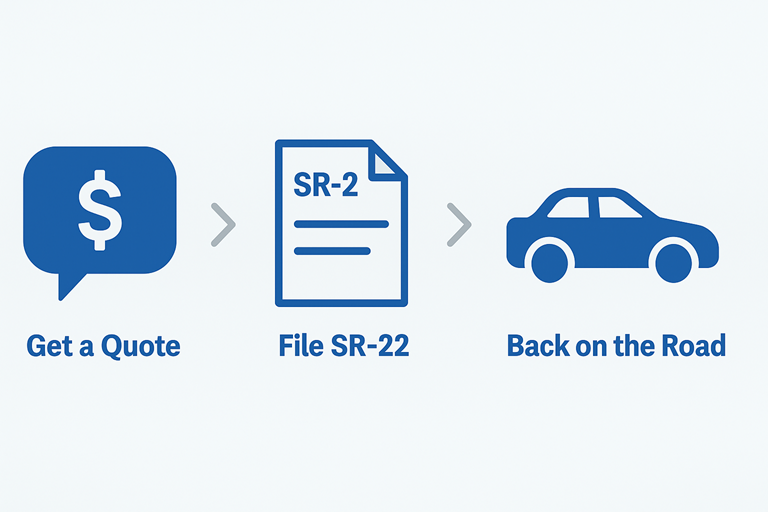

How SR‑22 Insurance Filing Works

- Get a Quote: We compare top insurers for the best pricing.

- Buy a Policy: Insurance is purchased, and the SR‑22 is filed electronically.

- Receive Proof: Documentation sent by email or mail—often within hours.

Do You Need SR‑22 Insurance?

If required by a DMV or court, you must maintain active SR‑22 insurance for your state. Don’t own a car? We offer non‑owner SR‑22 insurance policies that keep you in compliance even without vehicle ownership.

Official State SR‑22 Insurance Resources

Frequently Asked Questions

1. How long do I need SR‑22 insurance?

Most states require SR‑22 insurance for three years. Some may require it longer depending on the offense.

2. What happens if my SR‑22 insurance lapses?

If your policy lapses, your insurance provider will notify the state immediately, often resulting in license suspension.

3. Can I get SR‑22 insurance without owning a car?

Yes. A non‑owner SR‑22 insurance policy allows you to meet state requirements even if you don’t own a vehicle.

4. How much does SR‑22 insurance cost?

The form itself usually costs $15–$50. Total premiums vary based on your record, insurer, and state.

5. What’s the difference between SR‑22 and FR‑44?

FR‑44 (used in FL and VA) requires higher liability limits than SR‑22 and is typically issued after DUI convictions.

6. Can I switch insurers while carrying SR‑22 insurance?

Yes, but your new provider must file the SR‑22 before canceling the old policy to avoid a lapse.

7. Does SR‑22 insurance include full coverage?

No. It only proves liability. You’ll need to add comprehensive and collision for full coverage.

8. Do all states require SR‑22 insurance?

No. States like NY, DE, KY, NC, NM, and OK don’t use SR‑22 filings.

9. How quickly can I get proof of SR‑22 insurance?

We can typically file your SR‑22 electronically and provide proof the same day.

10. Do I need to maintain SR‑22 insurance if I move?

Yes. If it was required by your original state, you must maintain it for the full required period—even after moving.

Why Choose Foxx Insurance?

- ✅ Veteran‑owned & operated

- ✅ Same‑day electronic SR‑22 filings

- ✅ Affordable in multiple states

- ✅ Real, knowledgeable agents

- ✅ 10+ years serving high‑risk drivers