FR-44 Insurance in Florida: What It Is, What It Costs, and How to File

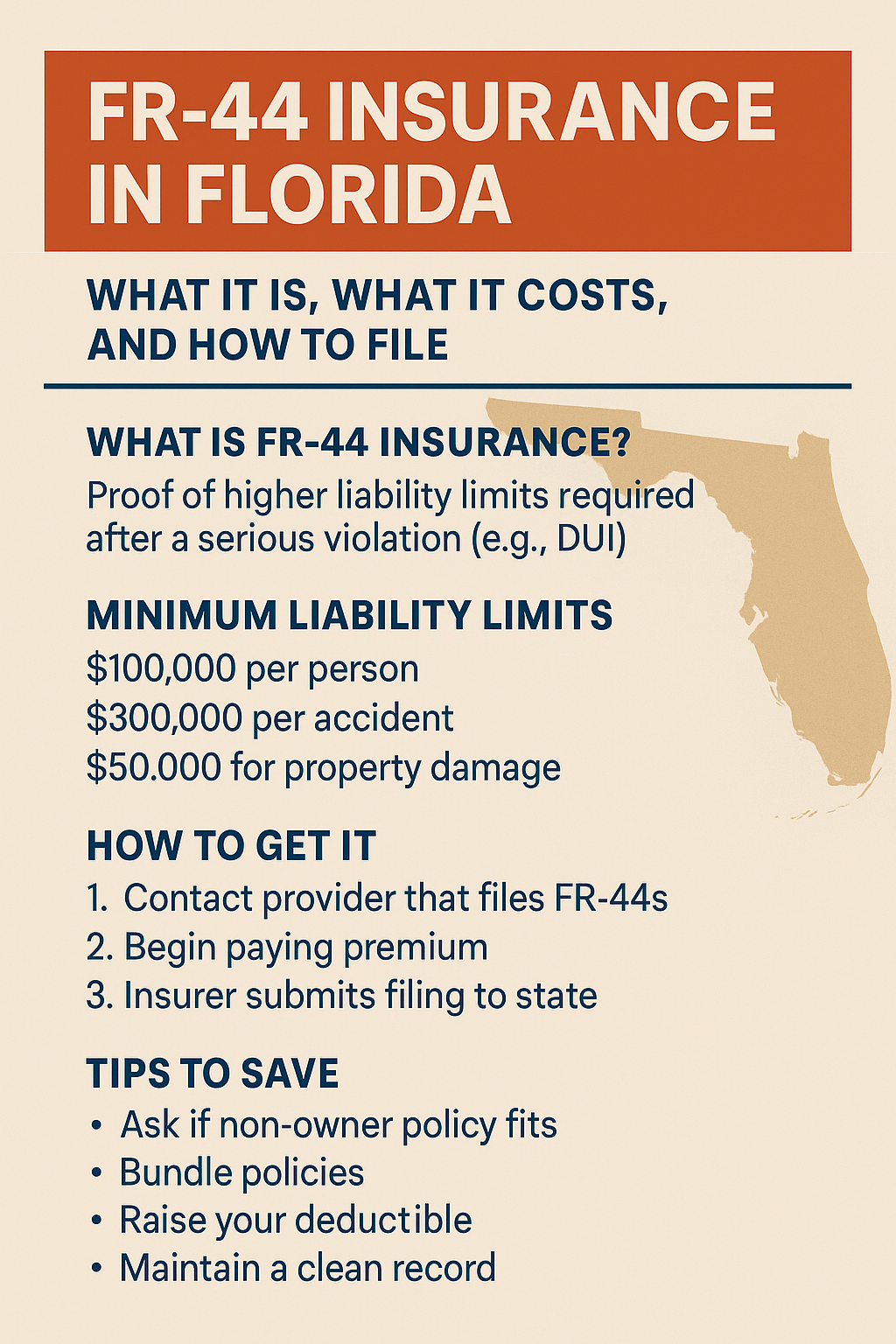

If you need FR-44 insurance in Florida, you might feel overwhelmed. This filing proves you meet Florida’s higher liability limits after certain violations, most often a DUI. However, the process is straightforward when you know the steps.

What Is FR-44 Insurance?

FR-44 insurance is proof of financial responsibility. Your insurer files it with the state to confirm you carry the required coverage. In Florida, an FR-44 is typically needed after a DUI conviction. Compared to an SR-22, the FR-44 requires much higher limits. If you do not own a vehicle, you can still meet the requirement with a non-owner policy.

How FR-44 Differs From SR-22

An SR-22 is used for less severe violations and requires lower coverage amounts. The FR-44 is for more serious offenses and demands higher liability limits.

Florida FR-44 Requirements

The Florida Highway Safety and Motor Vehicles (FLHSMV) requires FR-44 drivers to carry at least:

- $100,000 bodily injury liability per person

- $300,000 bodily injury liability per accident

- $50,000 property damage liability per accident

Alternative Coverage Option

Instead of split limits, you may carry a $350,000 combined single limit. These requirements last for three years from your license reinstatement date. As a result, it’s important to keep coverage active the entire time.

Source: Florida DHSMV DUI FAQs

How to Get FR-44 Insurance in Florida

Step-by-Step Process

- Contact a provider that handles FR-44 filings — Foxx Insurance can help.

- Select liability limits that meet or exceed Florida’s requirements.

- Your agent files the FR-44 electronically with the state, often within one business day.

- Pay the filing fee, usually $15–$25, along with your first premium.

How Much Does FR-44 Insurance Cost?

Factors That Affect Pricing

The filing fee is small. However, the higher coverage limits and the DUI can raise your premium. Costs depend on several factors such as your record, vehicle, location, and coverage choices.

Non-Owner Policy Option

A non-owner policy may cost less if you do not own a vehicle. It still satisfies the FR-44 requirement.

Ways to Save on FR-44 Insurance

Money-Saving Tips

- Choose a non-owner policy if you do not own a car

- Bundle with other policies to qualify for discounts

- Select a reasonable deductible

- Maintain a clean record during the FR-44 period

In addition, paying in full can help you avoid installment fees.